Some electronics, clothing, or sports equipment may be cheaper in the USA than your own country. Importing from the USA can therefore be worthwhile, although the dollar exchange rate fluctuates significantly over time. The same rules apply for imports from the USA as from any non-EU country. Imported electronics, clothing, and other goods may be subject to value-added tax and customs duty.

-

Table of Contents

- When Are Customs Duty and VAT Paid on Shipments From the USA 2025

- How to Pay Customs Duty and VAT on Imports From the USA

- Examples of When You Pay VAT and Duty on Shipments From the USA

- Customs Limits and Exemptions for Travelers from the USA

- How Customs Inspection Works After Arrival

- Frequently Asked Questions on Imports from the USA – Duty, VAT, Fees…

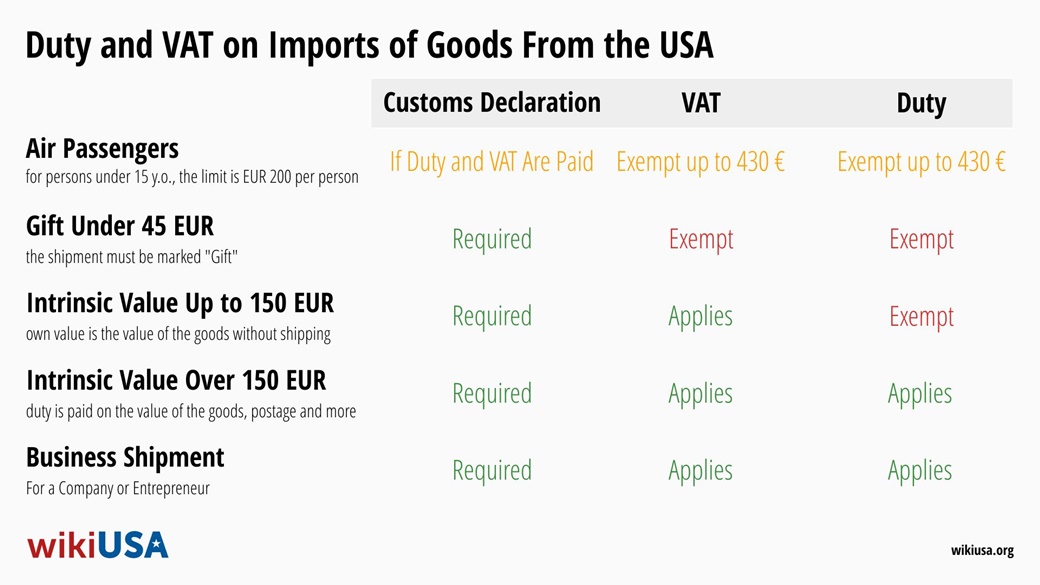

When Are Customs Duty and VAT Paid on Shipments From the USA 2025

💸 Value Added Tax (VAT) / Goods and Services Tax (GST)

VAT is charged on all shipments from the USA regardless of their value in many countries (for example, the UK charges 20% VAT on all imports).

The only exception to this rule is packages between private individuals that are marked as “gift” and whose value does not exceed €45$52Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. Such gifts still require a customs declaration, but VAT (and duty) will not be assessed because these shipments are legally exempt from those charges. The package must be clearly marked as a gift (Gift).

💸 Customs Duty

Customs duty is payable on shipments valued above €150$174Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025..

Shipments below this value are exempt from duty. (In the UK, the duty threshold is £135$181Converted using the exchange rate 1 GBP = 1.34 USD as of August 12, 2025., which is roughly equivalent to €150, and in countries like Australia and New Zealand, duty is generally not charged on goods below certain thresholds – see below for specifics.)

When calculating the €150$174Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025. duty threshold, only the value of the goods is counted, excluding shipping or insurance costs. However, the amount of duty itself is calculated based on the total sum of the goods’ value plus shipping and any additional fees (such as insurance).

💸 Customs Clearance Fees

If you handle the customs clearance yourself through the official customs systems in your country (for example, through an online portal provided by the customs authority), this is typically free of charge.

In practice, however, it is more common for the customs clearance to be conducted by the postal service or courier.

For instance, in the United Kingdom, Royal Mail will handle customs clearance for you and charge a handling fee of about £8$10.75Converted using the exchange rate 1 GBP = 1.34 USD as of August 12, 2025. for processing the import (according to their current price list). Other courier companies have their own procedures and fees.

In Australia, if a formal Import Declaration is required (for goods over A$1,000), the government charges an Import Processing Charge (currently around A$50 for electronically lodged entries under A$10,000).

In New Zealand, for goods over NZ$1,000 an Import Entry Transaction Fee (about NZ$60 including GST) is levied, and a biosecurity levy (~NZ$30) may also apply. These official fees are charged in addition to any duty and GST. No extra handling fee is collected if the seller has already charged and remitted the import VAT/GST at the point of purchase.

For example, many online retailers in the USA or China participate in schemes to collect VAT/GST on orders shipped to the EU, UK, Australia, or New Zealand. In such cases, the package is sent with taxes prepaid, and it will typically clear customs without any additional postal processing fee.

-

How to Pay Customs Duty and VAT on Imports From the USA

⚪ Basic Customs Terms

- Intrinsic value of goods = the value of the goods themselves, not including postage or insurance

- Customs value of goods = intrinsic value of goods + shipping costs (and potentially insurance and other fees)

⚪ Customs Exchange Rate

For currency conversion from foreign currency, customs authorities use official exchange rates. For calculation, you can use a duty/tax calculator or currency converter provided on the customs authority’s website. (Many customs agencies publish monthly exchange rates or have online calculators to help convert the value of goods for duty/VAT purposes.)

⚪ How Customs Clearance Works

Instructions for completing the customs clearance process and the required forms or applications can be found on the customs authority website. In general, after your shipment arrives, you will need to submit a customs declaration (either on your own or through the carrier).

Once the declaration is processed and any duties or taxes are paid, the goods are released for delivery.

⚪ Different Limits for Air Travelers

There is an exception to the above import value limits for travelers arriving by air. Travelers can bring in goods duty-free and VAT-free up to a higher personal allowance.

For example, in the UK goods are duty/VAT free up to £390$524Converted using the exchange rate 1 GBP = 1.34 USD as of August 12, 2025. per person (children under 17 have no allowance for tobacco or alcohol), in Australia up to 900 $$586Converted using the exchange rate 1 AUD = 0.65 USD as of August 12, 2025. per adult (450 $$293Converted using the exchange rate 1 AUD = 0.65 USD as of August 12, 2025. for those under 18), and in New Zealand up to 700 $$416Converted using the exchange rate 1 NZD = 0.59 USD as of August 12, 2025. per person.

If you return from a vacation in California with a suitcase full of clothing worth €400$465Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., you will not pay any VAT or duty upon arrival as it is within your personal exemption.

⚪ Determining the Amount of Duty

To find out the exact amount of customs duty for your goods, use your country’s tariff system (for example, the UK’s TARIC or online Trade Tariff tool, Australia’s Tariff Classification system, etc.).

You can look up the commodity code and corresponding duty rate and then calculate the duty. A frequent stumbling block is determining the correct product nomenclature – in other words, classifying the goods into the correct category among the many options, which can be easily confused by a layperson.

-

Examples of When You Pay VAT and Duty on Shipments From the USA

Customs clearance for shipments from the USA usually results in one of the following outcomes:

Scenario Declaration VAT Duty You order a phone case for €10$11.62Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., shipping costs €5$5.81Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. The customs value of the goods is €15$17.43Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. ✅ Yes ✅ Yes ❌ No Your aunt in the USA sends you a T-shirt worth €30$35Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., postage is €10$11.62Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. She declares it as a gift on the customs form. ✅ Yes ❌ No ❌ No You buy headphones for €140$163Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., shipping costs €20$23.24Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. The intrinsic value is €140$163Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., customs value is €160$186Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. ✅ Yes ✅ Yes ❌ No You order an iPhone for €800$930Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., shipping was another €20$23.24Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025.. The intrinsic value exceeds the €150$174Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025. duty threshold. ✅ Yes ✅ Yes ✅ Yes -

Customs Limits and Exemptions for Travelers from the USA

👕 Duty-Free Allowance for Souvenirs from the USA

Air passengers are entitled to bring in a certain value of goods duty-free and tax-free. In the United Kingdom, the personal allowance for goods (such as souvenirs, electronics, or clothing) is up to £390$524Converted using the exchange rate 1 GBP = 1.34 USD as of August 12, 2025. per person (or £270$363Converted using the exchange rate 1 GBP = 1.34 USD as of August 12, 2025. if arriving by private plane or boat).

In Australia, the allowance is up to 900 $$586Converted using the exchange rate 1 AUD = 0.65 USD as of August 12, 2025. for travelers 18 or older (450 $$293Converted using the exchange rate 1 AUD = 0.65 USD as of August 12, 2025. for those under 18). New Zealand applies a duty-free limit of 700 $$416Converted using the exchange rate 1 NZD = 0.59 USD as of August 12, 2025. worth of goods per person.

These allowances cover all goods brought in, including souvenirs, electronics, and clothing. If the total value of all goods exceeds the allowance, then import VAT/GST and customs duty (if applicable) will be charged on the entire value, not just the amount above the allowance.

🚬 Duty-Free Tobacco Allowance for Imports from the USA

Travelers can bring a limited quantity of tobacco products from the USA without paying duty, VAT, or excise tax. The specific limits vary by country:

- United Kingdom (and most of the EU): 200 cigarettes, or 100 cigarillos (up to 3 grams each), or 50 cigars, or 250 g of smoking tobacco. These amounts represent 100% of the allowance. You may split the allowance (for example, 100 cigarettes and 25 cigars would each use 50% of the allowance), but you cannot exceed 100% in total.

- Australia: 25 cigarettes (plus one opened packet of cigarettes), or 25 grams of tobacco products in total. This is the full duty-free allowance for tobacco; if you bring more, duty and GST will be charged on all tobacco in your possession above this small allowance.

- New Zealand: 50 cigarettes, or 50 grams of cigars or loose tobacco, or a mixture of tobacco products not exceeding 50 g in total. If you exceed this limit, you must declare all the tobacco and you will be charged duty and GST on the entire quantity.

These tobacco limits apply per person. If you bring in more than the allowed amount, you must declare it—otherwise, the excess tobacco will be seized and you could face fines or penalties. You also cannot combine allowances with another person (except in Australia, where family members traveling together may pool their general €900$1,046Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025./€450$523Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025. goods allowance, but tobacco and alcohol allowances generally may not be pooled).

🍷 Duty-Free Alcohol Allowance for Imports from the USA

Along with tobacco products, travelers over the legal age (usually 17 or 18 years, depending on country) can bring in a certain amount of alcohol from the USA without paying duty, VAT, or excise tax. The maximum quantities are roughly:

- United Kingdom: 42 liters of beer, 18 liters of still wine, and either 4 liters of spirits or strong liqueurs (over 22% alcohol) or 9 liters of sparkling or fortified wine or other alcoholic beverages up to 22% alcohol. (You can split this last category—for example, 2 liters of spirits and 4.5 liters of fortified wine would together use up the allowance.)

- European Union (for reference): 16 liters of beer, 4 liters of still wine, and either 1 liter of spirits over 22% or 2 liters of alcoholic drinks up to 22%. (The UK’s allowances are higher than the EU’s since Brexit.)

- Australia: Up to 2.25 liters of alcoholic beverages (total, regardless of type) per traveler age 18 or over.

- New Zealand: Up to 4.5 liters of wine or beer (for example, six 750 ml bottles of wine) and up to 3 bottles of spirits or liqueur (maximum 1.125 liters each) per traveler age 17 or over.

As with tobacco, these alcohol allowances represent 100% of your duty-free limit. You cannot, for instance, bring in both the full allowance of hard liquor and the full allowance of lower-strength alcohol.

If you exceed any of these limits, you must declare all of the alcohol you are carrying and you will be charged duty, excise, and tax on all of it. It is permitted, however, to also bring in additional alcohol beyond these categories such as 4 liters of still wine and 16 liters of beer (EU allowance) in addition to the spirits allowance – for example, a traveler to the EU can bring 4 L of wine and 16 L of beer duty-free alongside their spirits allowance, and similarly the UK allowances for beer and wine are separate from the spirits allowance.

💊 Duty-Free Allowance for Medicines and Fuel

In addition, travelers may bring in prescribed medications in quantities reasonable for personal use, and fuel that is in the standard tank of their vehicle, plus up to 10 liters in a spare portable container for each motor vehicle, without incurring customs charges.

Always check that any medication is legal in the country you are entering and carry a prescription or doctor’s note if appropriate.

-

How Customs Inspection Works After Arrival

Upon arrival back home (for example, arriving in the UK or another country from outside), you will go through passport control (for flights arriving from outside your home country or outside the Schengen area, in the case of the EU) and then collect your checked baggage.

With your luggage, you will pass through one of the customs control channels – essentially you either have something to declare, or you do not have anything to declare. Even if you do not declare any goods, customs officers can still select you for a random inspection of your luggage.

During the inspection, they may have your bags X-rayed, and if they see any suspicious indication, they will conduct a detailed search of your belongings. It’s always best to be truthful on your customs declaration and to proactively declare any items that exceed your duty-free allowances to avoid penalties or confiscation.

-

Frequently Asked Questions on Imports from the USA – Duty, VAT, Fees…

How high is the customs duty when importing a car from the USA?

Throughout Europe (and similarly in the UK), cars imported from the USA are generally subject to a 10% customs duty and import VAT (around 20% – for example, 20% in the UK or 21% in some EU countries).Cars classified as vintage or collectors’ vehicles over 30 years old are usually exempt from the duty. You can find a complete guide in the article Importing a Car from the USA.

I ordered electronics from the USA for $380. Will the postal service send me a notice to come to a branch and pay the duty and VAT?

The post will first ask you to provide authorization (a power of attorney) for them to represent you in customs proceedings. They will handle the customs clearance on your behalf.The assessed duty, VAT, and the postal handling fee for processing the shipment will then be collected on delivery (often as a COD – cash on delivery – payment or via an online payment link). If a courier service (such as DHL, FedEx, UPS, etc.) is delivering your package, their process and fee might differ, but they will similarly clear the item through customs and then bill you for the taxes and their service fee.

I want to order two shirts, each costing €80$93Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025., with free shipping. Will I have to pay duty and VAT?

If both shirts are shipped together in one package, you will be charged import VAT, and you will likely be charged customs duty as well, since the total value exceeds the duty-free limit (e.g., above €150$174Converted using the exchange rate 1 EUR = 1.16 USD as of August 12, 2025. in the EU, or above £135$181Converted using the exchange rate 1 GBP = 1.34 USD as of August 12, 2025. in the UK).A legal way to avoid paying duty in this case would be to order each shirt separately so that each shipment stays below the duty threshold. However, for a commercial shipment, you will always have to pay import VAT regardless of the value, so even if you split the orders, VAT will still be due on each package.

I’m flying to the USA, and I plan to buy 4 to 5 iPhones and Apple Watches for myself and friends. If I take them out of their boxes and carry them as used items, can I avoid paying VAT and duty when bringing them back?

You will most likely not avoid the charges. Customs officers are well aware of this trick, and bringing that quantity of identical electronics clearly exceeds what one person would normally need for personal use. It also exceeds the personal import limit.Even if the devices are unboxed, the volume (4–5 of each) will attract attention and you would be liable for import VAT and possibly duty on them.

I want to buy an iPhone through a friend in the USA and avoid paying duty and VAT. If he writes on the customs declaration that he’s sending me “glasses,” will the package get through without charges?

Customs inspects most packages with X-ray scanners. If they suspect that the description on the label doesn’t match the actual contents, they will open the package for a closer inspection. Misdeclaring contents is risky and can lead to confiscation of the goods and penalties.My sister in the USA is sending me her used slipcovers for two couches. Will I have to pay VAT or duty? She doesn’t have the receipts and doesn’t remember how much they cost.

You’ll need to attach a customs declaration label to the package with a description of the contents and an estimated value. Used personal items are still subject to import regulations.If the customs officials doubt the declared value of the shipment, they have the authority to determine a value themselves (for example, based on similar goods).

This article is up to date as of 6 August 2025. For more information, refer to the official website of your country’s customs authority (e.g., HMRC for the UK, the Australian Border Force for Australia, or New Zealand Customs).

10 Best Photo Places in the USA

10 Best Photo Places in the USA

Contribute with Your Question or Personal Experience