Electronics, clothing, and other goods tend to be cheaper in the USA than in Europe. Although goods are also becoming more expensive in America, importing from overseas can still be worthwhile. Importing iPads, iPhones, or other electronics is subject to laws that can impose a tax or duty on the goods. The same laws apply to imports from the USA as to goods from any other non-EU country.

-

Table of Contents

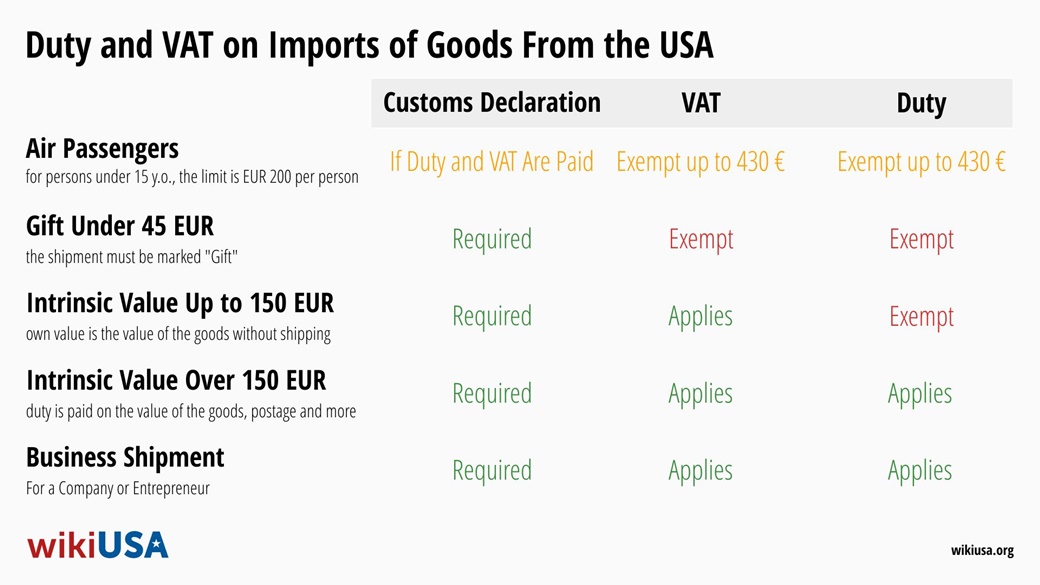

Duty and VAT on Shipments From the USA to the EU 2025

💸 VAT

VAT is payable on all shipments from the USA, including those with a value up to €22$26Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025..

Gifts between private individuals with a value up to €45$53Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025. are exempt from VAT. Although the same customs declaration is made for these as for shipments up to €150$176Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025., neither VAT nor customs duties will be charged. The shipment must be marked as a gift.

💸 Duty

Duty is payable on shipments over €150$176Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. Shipments with a lower value are exempt from paying customs duty.

The intrinsic value of the consignment (excluding transport costs) determines whether duty is payable. However, the amount of the duty itself is calculated on the amount including transport costs and any other charges.

💸 Customs Clearance Costs

The post office in the recipient’s country typically handles the customs procedure.

If the customs goods are processed under the IOSS regime, no fee is charged. IOSS (Import One-Stop Shop) refers to a situation where the seller is registered for VAT in the European Union and the customer buys goods already plus VAT.

-

Important Information About Paying Duty and VAT on Shipments From the USA

⚪ Basic Customs Terms

Three concepts to understand for customs duties on imported goods:

- Intrinsic Value of Goods = the value of the goods excluding postage and insurance

- Total Value of Goods = the intrinsic value of the goods + postage and insurance

- Total Value of Goods = intrinsic value of goods + postage

⚪ Other Limits for Air Passengers

An exception to the limits applies to air passengers. For them, goods are exempt from customs duty and VAT up to €430$505Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025. per person, and for children under 15 years of age up to €200$235Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025. per person.

⚪ Determination of the Amount of Duty

The TARIC system is used to determine the amount of duty, and you can calculate the amount yourself. The primary challenge is the nomenclature of the goods, i.e., their classification into the relevant category. There are a vast number of categories that can be easily confused by the layperson.

-

Examples: When VAT and Customs Duties Will Be Paid

Customs clearance for USA shipments can always result in one of three outcomes:

Situation Declaration DPH Clo You order a phone case for €10$11.73Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025., postage costs €5$5.87Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. The total value of the item is €15$17.60Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. ✅ ✅ ❌ An aunt from the USA sends you a t-shirt for €30$35Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025., postage is €10$11.73Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. The customs declaration will state that it is a gift. ✅ ❌ ❌ You buy headphones for €140$164Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025., postage costs €20$23.47Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. The actual value is €140$164Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025., the total value is €160$188Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. ✅ ✅ ❌ You order an iPhone for €800$939Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025., shipping cost is an additional €20$23.47Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. The actual value exceeds the €150$176Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025. threshold. ✅ ✅ ✅ -

Tax Exemption for EU Travelers

👕 Customs Limit for Souvenirs From the USA

Air passengers are exempt from paying VAT and customs duties up to €430$505Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025. per person. For passengers under 15 years of age, the limit is €200$235Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025. per person. This amount applies to all goods, including souvenirs, electronics, clothing, and more.

🚬 Customs Limit on Tobacco Imports From the USA

The following quantities of tobacco are exempt from duty, VAT, and excise tax:

- 200 cigarettes,

- 100 cigars up to 3 grams each,

- 50 cigars,

- 250 grams of smoking tobacco.

The total limits apply per person and each item represents 100% of the limit. Hence, you cannot import, for instance, 200 cigarettes and 100 cigars at the same time. These items can only be combined such that the total does not exceed the 100% allowed. For example, 100 cigarettes and 25 cigars can be imported.

🍷 Customs Alcohol Limit for Imports From the USA

Along with tobacco products, individuals 17 years of age or older may import alcohol without paying duty, VAT, or excise tax, up to the following maximum quantities:

- A total of 1 litre of alcohol and alcoholic beverages containing more than 22% by volume, or undenatured alcohol containing at least 80% by volume,

- A total of 2 litres of alcohol and alcoholic beverages with an alcoholic strength by volume not exceeding 22%.

As with tobacco products, for alcohol both items represent 100% of the total quantity allowed. It is not possible to import 1 litre of 40% alcohol and 2 litres of 10% alcohol at the same time. However, you can import, for example, 4 litres of still wine and 16 litres of beer simultaneously.

It is not possible to import more tobacco products or alcohol even if you agree to pay duty, VAT, and excise duty.

💊 Customs Limit on Medicines and Fuels

You can import medicines in quantities corresponding to personal needs. Also, you can import fuel in the normal tank of your vehicle, plus up to 10 litres in a portable container for each motor vehicle.

🛃 Customs Control on Arrival in the EU?

On arrival in the EU, you will go through passport control (for flights from outside the Schengen area) and collect your checked baggage. You will then pass through one of the customs control gates, either having or not having items to be cleared. Even if you do not declare any goods, you may still be selected by customs for a random search of your luggage.

During the check, your luggage is x-rayed, and if there’s any suspicion, a detailed search is carried out.

-

FAQ: Importing From the USA, Customs, VAT, Fees…

How High Is the Duty When Importing a Car From the USA?

Throughout the European Union, cars imported from the USA are subject to a uniform duty of 10% and VAT at the appropriate rate. Veteran cars over 30 years old are exempt from duty. For full instructions, see the article Importing a car from the USA.

I Want to Order Two T-Shirts, Each Priced at €80$94Converted using the exchange rate 1 EUR = 1.17 USD as of July 10, 2025.. Shipping Is Free. Will I Pay Duty and VAT?

If both t-shirts are sent as part of one shipment, you will be charged VAT and duty. You can legally avoid paying duty by ordering each t-shirt separately. However, VAT will always apply.I’m Flying to the USA to Buy an iPhone and Apple Watch for Myself and Friends. Four to Five of Each. If I Unpack the Electronics From the Box and Ship Them as Used, Will I Avoid Paying VAT and Customs Duty?

Unlikely. Customs officials are aware of such tricks. Additionally, the quantity mentioned exceeds the normal requirement of one person and surpasses the allowed limit.I Want to Buy an iPhone Through a Friend in the USA and Avoid Paying Duty and VAT. If He Writes on the Customs Declaration on the Box That He Is Sending Me Glasses, Will It Go Through?

Customs inspects all shipments by x-ray. If they suspect that the description on the label does not match the contents, they will open the shipment.My Sister Is Sending Me Her Used Covers for Two Couches From the USA. Will I Pay VAT and Duty? She Doesn’t Have the Receipt for the Covers and Doesn’t Remember How Much They Cost.

A customs declaration label must be affixed to the package of covers, detailing the shipment and providing an estimated price. If customs officials are doubtful about the declared customs value of the shipment, they can determine it themselves.

The article is current as of January 2, 2024. Procedures in different countries may vary. For more information, see the European Union website.

10 Best Photo Places in the USA

10 Best Photo Places in the USA

Contribute with Your Question or Personal Experience